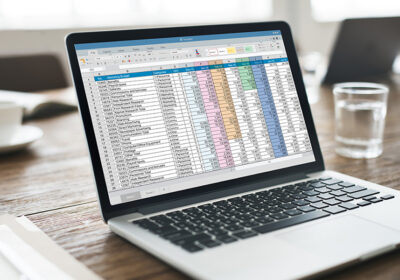

Exploring advanced excel functions for streamlined financial analysis

Introduction

Microsoft Excel is a powerful tool for financial data analysis, and while many are familiar with its basic functions, there are lesser-known, advanced functions that can revolutionize your approach to financial analysis. In this article, we will delve into these advanced excel functions that can streamline and enhance financial data analysis.

1. Xnpv and xirr functions

The xnpv (net present value) and xirr (internal rate of return) functions go beyond basic npv and irr calculations. They allow you to account for irregular cash flows and varying discount rates. Xnpv calculates the net present value based on specific dates for each cash flow, while xirr calculates the internal rate of return for cash flows with irregular timing. These functions are invaluable for complex financial modeling and investment analysis.

2. Index and match combination

The index and match functions are often used together to perform advanced lookups. While vlookup and hlookup have their limitations, index and match offer greater flexibility and accuracy. You can search for data in rows and columns simultaneously, making it ideal for multidimensional financial data analysis.

3. Sumifs and countifs functions

Sumifs and countifs allow you to perform conditional summing and counting based on multiple criteria. You can sum or count data that meets specific conditions, making it easier to extract relevant financial information from large datasets. For example, you can calculate the total revenue for a specific product category within a given date range.

4. Offset and indirect functions

The offset function enables you to create dynamic ranges in excel. This is especially useful for financial models that involve forecasting or scenarios. By combining offset with the indirect function, you can build dynamic references to cells or ranges that change based on user inputs or assumptions.

5. Aggregate function

The aggregate function provides a wide range of aggregation options beyond the standard sum, average, max, and min. It allows you to perform calculations while ignoring hidden rows, error values, or other specified criteria. This function is particularly valuable when working with data that may contain outliers or errors.

6. Textjoin function

The textjoin function simplifies the process of combining text from multiple cells. In financial analysis, this function can be used to concatenate values with specified delimiters, making it easier to create custom financial reports or statements. For example, you can concatenate account numbers with commas for a consolidated list.

7. Cube functions

Excel’s cube functions, including cubevalue, cubemember, and cuberankedmember, enable you to interact with external data sources, such as olap (online analytical processing) databases. These functions are valuable for in-depth financial analysis and reporting, especially when dealing with large and multidimensional datasets.

8. Power query

Power query is an excel add-in that provides advanced data transformation and data connectivity capabilities. It allows you to import data from various sources, perform data cleansing, and shape data for financial analysis. Power query can significantly reduce the time spent on data preparation and transformation tasks.

9. Array formulas

Array formulas are powerful but less commonly used. They perform calculations on multiple values in a range and return a single result. These formulas are suitable for complex financial calculations, such as monte carlo simulations or sensitivity analysis. Array formulas can handle intricate scenarios where standard functions fall short.

10. Goal seek and solver

Excel’s goal seek and solver tools are essential for optimizing financial models. Goal seek helps you find the desired input value to achieve a specific output, while solver allows you to set up and solve complex optimization problems. These tools are indispensable for scenario analysis, budgeting, and decision-making.

Conclusion

By exploring and mastering these advanced excel functions, financial professionals can streamline and enhance their data analysis capabilities. These functions open up new possibilities for handling complex financial data, conducting in-depth analysis, and making data-driven decisions with precision. Incorporating these advanced functions into your financial analysis toolkit can revolutionize your approach to data modeling, forecasting, and reporting, ultimately leading to more informed and strategic financial decisions.